Charles Thomas Munger was my investment mentor. He, at a high-score age of 99 years young, sadly left us to manage Berkshire Hathaway’s celestial operations “up North”, on 28 November 2023.

I would like to pay my respectful tribute to my investment superhero – The Munger Man.

To me, the highly admired Munger navigated a highly tense and complicated world of finance in his wise and uncomplicated (clear-minded) style.

Charlie Munger and Warren Buffett were admirably and uniquely, not into the spoils that money brings but more into their adventurous pursuit of increasing their reservoir of wealth.

The humble and fun-loving duo were never extravagant in their spendings and lifestyles.

Trained as a lawyer and an avid poker player, Charlie Munger was the John Lennon of Berkshire Hathaway. He was the much-needed pessimist in the highly respected and beloved investment company. He welded the leash to Warren Buffet’s eagerness and optimism.

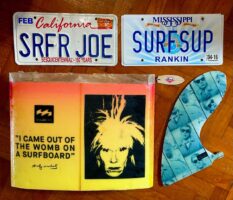

My all-time favourite Charlie Munger (on-line image above) quip – “Usually I don’t use formal projections. I don’t let people do them for me because I don’t like throwing up on the desk.”

In Japanese business culture, we know that the real boss is positioned subtly behind the talking head who is engaging with you.

While Warren Buffet starts the business conversation, Charlie Munger will speak only when necessary.

When Charlie speaks, not one to mince his words, we (the lowly Munger-like investor wannabes) listen attentively.

I provide some of my personal favourite Munger’s wise golden nuggets that he imparted over the years below:-

“The best armour of old age is a well-spent life preceding it.”

“All I want to know is where I’m going to die so I’ll never go there.”

“Early on, write your own obituary – and then behave accordingly.”

“You’ll do better if you have passion for something in which you have aptitude. If Warren Buffett had gone in ballet, no one would have heard of him.”

“A man who jumps out of a building is okay until he hits the ground.” (Munger’s take on government deficit.)

“Capitalism without failure is like religion without hell.”

“Usually I don’t use formal projections. I don’t let people do them for me because I don’t like throwing up on the desk.”

“If I can be optimistic when I’m nearly dead, surely the rest of you can handle a little inflation.”

“The fundamental algorithms of life – repeat what works.”

“You can learn a lot from dead people. Read of the deceased you admire and detest.”

“Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.”

“A lot of people with high IQ are terrible investors because they got terrible temperaments. Temperament is more important than brains.”

Your witty wisdom (on life and investment) will be sorely missed, Mr. Munger!

Charlie’s a well-read wise and worldly man, I urge you all to research further on Charlie Munger’s amazing life, investment achievements and valuable insights.

R.I.P. Sir!

Charlie Munger was a deep admirer of Mr. Lee Kuan Yew, the father of modern cosmopolitan Singapore – which inspired me to pen the following Local Tribute.

Meanwhile Closer To My Home

I want to take this opportunity to tip my hat to Singapore’s Favourite Sons of Nation-Building and Corporate Excellence – Messrs. J. Y. Pillay and Koh Boon Hwee.

Joseph Yuvaraj Pillay

J. Y. Pillai (above image), for 34 years, was one of Singapore’s top-ranking civil servants, one of the pioneer architects/masterminds who helped build modern Singapore’s bustling economy after its independence in 1965.

Mr. Pillay wore many crucial top hats for Singapore – Chairman of Singapore Airlines (1972-1996), Managing Director of the Monetary Authority of Singapore, (1985-1989), Chairman of Singapore Exchange (19999-2010), Chairman of Council of Presidential Advisers (2005-2019), Chairman of Tiger Airways (2011-2014), Chancellor of Singapore Management University (2015-2019).

Mr. Pillay served as Singapore’s acting President for 13 days from 1 to 13 September 2017 as an interregnum between Tony Tan and Halimah Yacob during the 2017 Singapore president election.

His most significant contribution during his civil service was, as Chairman (1972-1996) he built Singapore Airlines (SIA) into a leading highly admired world-class carrier.

In 1978, his bold and calculated move to purchase 19 Boeing aircrafts, including multiple Boeing 747s, at the cost of US$900 million for the airline, made headlines worldwide as “the sale of the century”, as it was the largest purchase at the time by any airline in the world.

J. Y. Pillay has promised me he’ll let me buy him rounds of red wine next time we meet at our favourite private members’ Club.

Koh Boon Hwee

Boon Hwee (above image) is a busy man who wears numerous crucial hats of top leadership of national corporations and has impeccable corporate vision.

He has assumed Chairmanships for DBS (Development Bank of Singapore), Singapore Telecom Group, SIA Engineering company. He sat on the boards of Singapore Airlines, Temasek Holdings and countless major established companies.

Boon Hwee was my personal client back in my heady days as a senior partner in my management consulting days.

I’ve never seen Boon Hwee not having that million-dollar smile on his radiant face. Seriously.